For the last few years the Japanese Ministry of Agriculture, Forestry and Fisheries has been publishing reports about the Japanese tea situation. The reports normally include the overview of production, demand & consumption, import & export, etc. Most of these reports are only available in Japanese. A few exceptions were a report published in May 2017 and the most recent one in December 2020, that were released in English. Highlights of the most recent report are below.

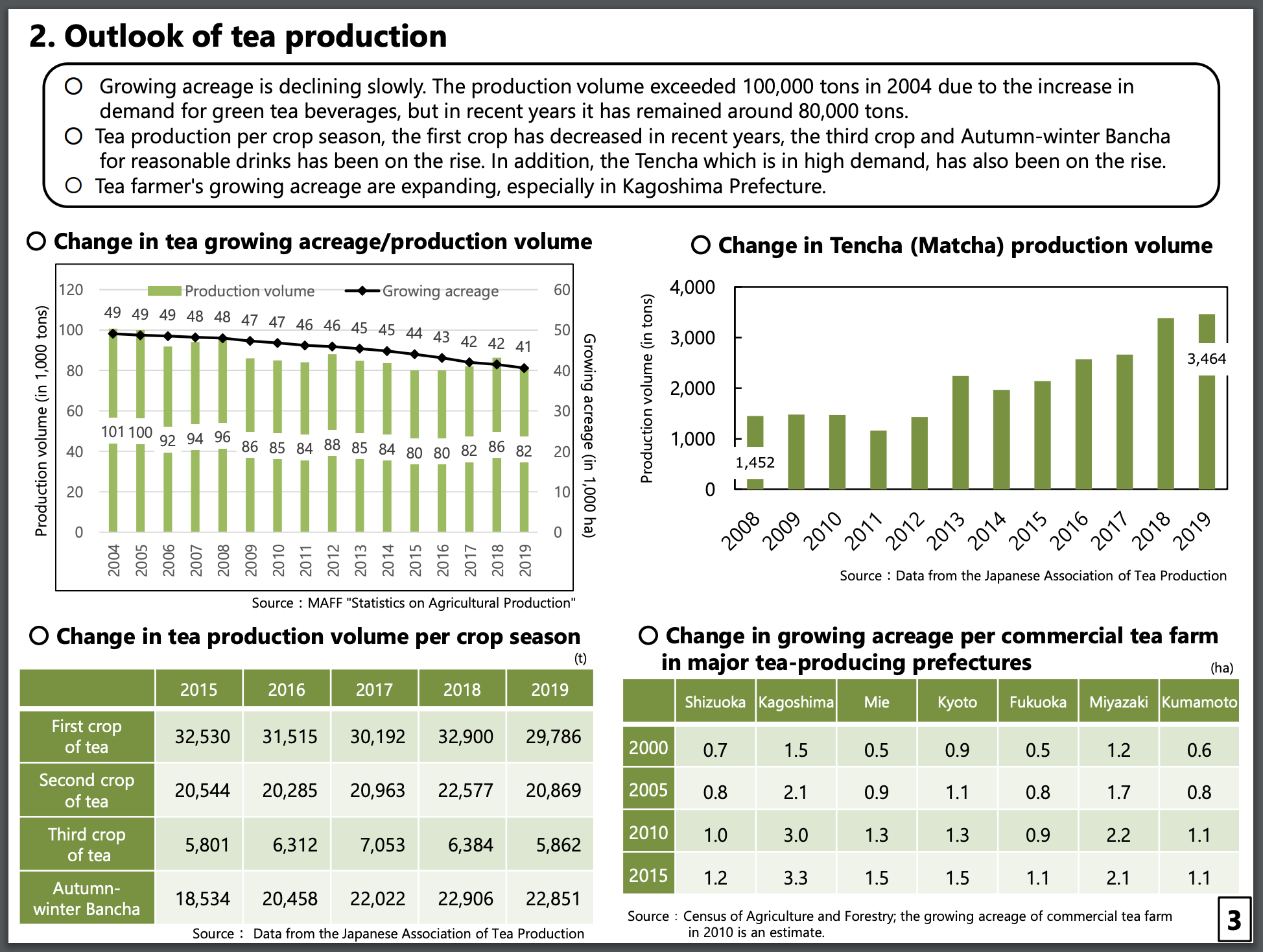

Currently three largest tea producing regions are Shizuoka, Kagoshima and Mie, and together they account for about 70% of Japanese tea production. Japanese tea production peaked in 2004 at 101,000t , and has been going down since then. In recent years it is usually around 80,000t. One exception is tencha (the material for matcha), the production of which has been increasing. Between 2008-2019 the production grew by 139% from 1,452t to 3,464t.

Looking at the Japanese tea demand domestically the demand for loose leaf tea has been continuously decreasing since 2003. The demand for tea beverage products, on the other hand, has been growing. However the tea used for beverage products is normally lower in grade. This together with the decrease in the loose leaf tea demand is reflected in the steep decrease of the tea price between 2003 – 2019.

The decrease in the tea demand and in tea price correlates with the decrease in the tea producer population. Between 2000-2015 the number of commercial tea producing households decreased by 62%, from 53,687 in 2000 to 20,144 in 2015. The average area of a tea farm, however, is increasing. Those, who continue tea farming, face pressure to inherit the farmland from those who quit tea farming. Another pressure is the aging tea farmer population as well as the increasing age of the tea bushes. More than half (or about 56%) of the tea farmers are aged 65 years or older. 37% of tea farm land has tea bushes over 30 years old. This raises concern about the decline in yield and quality.

One positive statistic in recent years is the growth of tea export. Between 2001-2019 Japanese tea exports grew almost tenfold from 599t to 5,108t. The top five importers of Japanese tea currently are: USA (29%), Taiwan (27%), Germany (7%), Singapore (6%), Thai (5%). According to FAO IGG between 2017-2027 world green tea production is expected to grow2.1 fold and green tea trade is expected to grow 1.6-fold. With that in mind Japanese government expects the export of the Japanese tea to grow from about 5,000t in 2018 to about 25,000t in 2030; and is creating measures to promote the tea industry and culture.

You can find the full report in detail here.

*Image source: MAFF